Kroger Deductions 101

Transcript

[00:00:00] Allie Truong: Hello. Hello. Hello. Welcome.

[00:00:11] Peter Spaulding: I'm going to wait a little bit for people to trickle in. We'll do our usual nonsense. Allie, how are you doing today?

[00:00:20] Allie Truong: I'm doing good. How about yourself?

[00:00:23] Peter Spaulding: Not too bad. Not too shabby. So we're going to start out with a fun question today for everyone. Based off of this weekend's Historic box office success.

Let us know in the chat. Are you team Barbie? Are you team Oppenheimer? Or are you team Barbenheimer? Allie, what's your what's your answer?

[00:00:49] Allie Truong: Man, I'm gonna have to say, I'm gonna sound like I'm talking out of both sides of my mouth. I only saw the Barbie movie this weekend because that's what I had time for.

The double feature, I love the idea. And, you know, my background is marketing, so for me to see all of the fantastic marketing that has happened between the two movies and, you know, just being on polar opposites, I have to say Barbenheimer is what I would go with, but I'm so excited to see Oppenheimer as well.

[00:01:22] Peter Spaulding: Same exact answer for me. I, you know, in a pinch, I had to pick one and I picked Oppenheimer because, I mean, we're just, we're being such stereotypes here, but I really wanted to do the double feature too. And it was so fun going to the movies. After we watched Oppenheimer, we were sitting around talking about it a little bit and one of the Barbie movies let out.

And it was like, I felt like I entered Barbie land for a second. Like everyone was walking past and they're like, so what are we going to do next? Where are we going now? And it's like they're all like hopping in their Jeeps and stuff. And it was, it was so like, it was such an awesome experience. And I wish so badly that I'd watched Barbie this weekend too, but I mean, we're grownups and, you know.

Yeah, that's, that's life. You can't just spend your whole day at the

[00:02:12] Allie Truong: I think you can. After this, let's get out of here. Let's go. Let's go do the double feature.

[00:02:18] Peter Spaulding: All right. So let us know in the chat. We only, we only have one response so far. I'm sure that there's more of you. Team Barbie, Team Oppenheimer, or Team Barbenheimer.

I am also Team Barbenheimer but I only watch Oppenheimer. And I, and I loved it. I'm really excited to see Barbie too. Brian says he's Team Oppenheimer. So as of now. It's tilted in the Oppenheimer in Oppenheimer's favor. But yeah, all right. Let's go ahead and get started. All right. This is us.

You've probably you're probably somewhat familiar with us by now. If you've been here before, if not welcome, if you're here for the first time we're so happy to have you. We do the content coordination on the SupplierWiki team here at SupplyPike. So basically our job is to just kind of. Provide you guys with as much sort of free resources as as possible within our means to help y'all succeed as suppliers.

And today we're going to talk about Kroger, but we're also in Walmart, Target, and Amazon. And the, the. Our main start, because we're a Northwest Arkansas startup, our main start was Walmart. So Walmart, we kind of grew up in Walmart's backyard and we really kind of got into the deduction space from there.

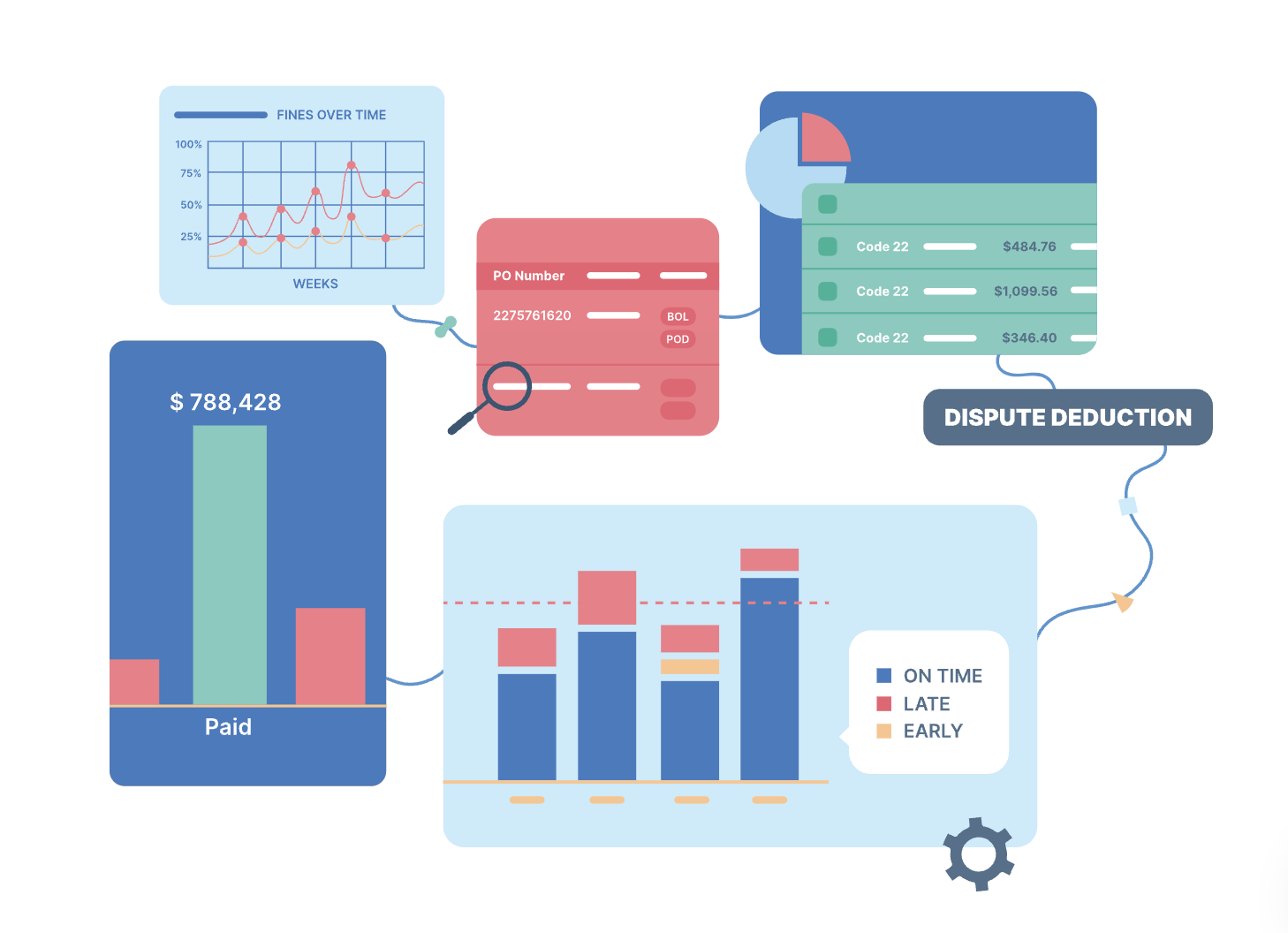

But now we're trying to grow, we're trying to expand a little bit. So it's a little bit of our background. So the course for today, this is an introductory Kroger course. We have a few others, one on netting that has a lot of views on our YouTube. So. If you want to search our YouTube or the SupplierWiki website for more on Kroger please do that.

We have a little bit more there too, but today we're going to be talking kind of the, the consequences of deductions for Kroger suppliers as, as at a kind of introductory level. Then we'll be talking about visibility, which is a huge kind of issue for deductions of all sorts. How do you actually how do you actually know what's going on?

And then when you do know what's going on, how do you actually know what's valid or not? These are kind of the evergreen issues that suppliers have. And then finally, we'll be getting into disputing a little bit with Kroger before we do the Q& A and discussion period at the end. A couple of FAQs. So people always want to know if you're going to get a copy of the slide deck, if you're going to get a copy of the recording.

You won't get a copy of the recording, but we do put everything up on YouTube. So you'll receive a a link to watch the video as well as a copy of the slide deck. So don't worry too much about taking super rigorous notes you'll be able to have access to this all later on. And another kind of common question or misunderstanding that we have is the difference between the chat and the Q& A.

Basically, We get a lot of questions and so we like having the Q& A as a kind of as a way for me while Ali's kind of going through the content to determine is this question appropriate for halfway through the webinar or should I save it for the end and, and all that stuff. So if you have a question kind of for us go ahead and put it in the Q&A.

The chat is for everything else. So the chat is for any kind of public comments you have. If we ask all of y'all a question and we want your feedback on something like the Barbenheimer situation, that's what the chat is for. So if you do have a question but your question is for everyone, it's not just for us, then go ahead and put it in the chat.

Yeah, we like to have the, we like to have it separate so that if you wanted to submit a private question you could. And it also helps us just kind of organizing the webinar as we go. Okay, I talked about this a little bit already. Our, the, the parent company, our company's supply Pike, and we're basically a SaaS company, a software as a service company that is that is really just trying to help people reduce sorry, help CPG suppliers reduce revenue loss in as many kind of ways as possible.

And the SupplierWiki team, which is our team is is. Our goal is to just kind of generate the content. So that's kind of the difference there. But these are some of our partners down here that we're really proud to work with. We have a few more kind of big names that we're excited to add to this list coming up here in a little bit.

So but these are our proud partners and we, we've been having a pretty big impact. Again, this started in Walmart. But we're mostly just proud of the software. We're really proud of the fact that we can kind of help people earn the money back that they've not rightfully lost and help people to improve compliance and improve their supplier performance across the board.

[00:07:34] Allie Truong: All right. Thank you, Peter, for that introduction. I'm glad to have everybody on the webinar today. Like Peter said SupplyPike, we started in Walmart, so I may make some Walmart references today. But really, we're here to talk about Kroger AP deductions and the process of disputing those. So let's get into today's content.

All right, so just kind of a quick overview about accounts payable deductions. Depending on if you're new to the Kroger business or new to the finance sector in CPG Suppliers, there's lots of different ways that retailers do the accounts payable deduction system or deducting those. Today we're focusing on Kroger, like I said.

Kroger deductions are going to be found on the Lavante portal, and that is created by PRGX. And we'll talk a little bit about them as well. Just to note, they do a couple different things, mainly with the retailers that we work with, when we see them on the finance sector. You might see them if you are doing Walmart post audits, oftentimes they're leading that as a third party for Walmart.

But with Kroger, they are essentially the third party that is handling the disputes within the Lavante portal. So they actually host the Lavante site and review all deductions that are coming through, which is helpful to understand. If, when we get into the part about understanding how to dispute these deductions, you're really not talking to a Kroger buyer or Kroger team, you're talking to a third party that is acting in Kroger on Kroger's behalf.

So all Kroger suppliers should have access to Lavante. If you're having an issue with Lavante, I'd talk to your site admin or someone else on your team, but essentially that's pretty table stakes for AP deductions at Kroger. So Lavante is the portal where you're going to review your supplier invoices, Kroger payment, and sometimes you will receive deductions from Kroger in this as well.

So Lavante is also the portal where suppliers will dispute these deductions, and that's helpful that it's All in the same place. Some suppliers like Walmart have different portals that you have to go into find proof documentation versus disputing versus actually viewing your invoices. So it's really nice that Kroger kind of bundles this together.

All right. And then just kind of set the stage about what deductions are. Deductions are associated with a particular supplier invoice. That's going to be helpful when we're talking about how you look these up in Lavante. but also understanding what a deduction can contain. So deductions are going to be tied to an invoice because they are literally deducting a percent or an amount based on the type of deduction from your invoice.

And with each deduction, you're going to have information such as UPC, item description, the deduction amount from the check and quantity, deduction code and code description. Usually we see it to be a deduction amount, a portion of your invoice, but it can be up to the full amount of the invoice depending on the severity or the type of claim.

We'll kind of get into that here in a second. And just to be clear a deduction is going to be withheld from the payment by Kroger. So you'll go and look at your invoice and you realize that you're supposed to be paid a hundred dollars. Let's just make it a small amount, but really the check says 80.

You're wondering what that difference is. Most likely that's going to point to a deduction. All right, and we would be remiss if we didn't talk about accounts receivable or AR fines. So In the world of Kroger, it can be different depending on the retailer that you're going into. We're really just focusing on AP deductions today, and those can be identified as associated deductions.

Accounts receivable fines can also be viewed in Lavante. These will show up as invoices, but they are invoices from Kroger to the supplier. So, We could go into that on a different webinar. ORAD Late Delivery Fines is an example. So if anyone's interested in us creating a AR Kroger webinar, we'd love to do that.

We just want to hear from your feedback. Really today we're going to be focusing on AP deductions. Alright, and as we're kind of exploring the landscape of Kroger deductions, it's important to point out the differences between some other suppliers. So if you're familiar with Walmart or Target, they have up to, I believe Walmart's about 75 plus codes.

Target has a hundred and something codes, and they're used at varying degrees and can get really specific. With Kroger, there's about eight types of AP deduction codes that we have seen more commonly between, you know, regularly seeing these with suppliers that we work with, or once in a blue moon seeing these.

And it's actually nice that there's only about eight types, because you can really start to understand what buckets your deductions. filter into, and then learning how to dispute those as well. So we're actually going to go over the several different types of AP deductions that are associated with a code description.

We'll kind of get into that here in a second as well. All right. So the first one is code two, and that is promo allowance difference. You will. see some of these have a let, two letters attached to them. That's going to be the deduction code. We'll have a chart at the end that will kind of go through all of these, but essentially this OI means off invoice, which is going to make sense here in a second as we get into what a promo allowance difference is.

So allowances are taken from an invoice. Really those are set up. Normally, but in this case with a code 2 or promo allowance different, this is going to be a manual correction for that allowance. Whether it's a salvage, co op, trade, or any of the allowances that are due off invoice. So typically, promo allowances are designated for certain types, for a certain time period, and you may receive this type of deduction if You're having an error with the timing there.

If you're having an error with the, the items that were supposed to be on that allowance. So there can be a couple of different areas where you would see there be issues with a code too. And we're kind of, as we go through this section, we're going to talk a little bit about what these codes are and how you can prevent them.

And then when we get into the next section, we'll talk a little bit, how, a little bit about how you can start to dispute those and the specific requirements for each of these codes. So typically with. Promo allowances, they're agreed on in advance through promotional contracts. So you can expect these to occur.

However, if something is set up incorrectly you may want to go back and check that to make sure that you're not being deducted an amount that you shouldn't be. All right. And then with code three, that's your promo cost difference. And that is the deduction the difference between the unit price of what was billed to Kroger and what.

So, for example, let's say you were selling in a new item and it was supposed to be costing 5 but what Kroger started to pay was 5. 6, they're going to come back and say, Hey, you know, the contractor who said 5, you billed us for 6. We want to deduct that amount off of this check to match the actual price we're supposed to pay.

And then how to prevent those. If Kroger sends a purchase order with the wrong unit cost of an item, the supplier should reject the PO. So that's just important to kind of understand ahead of time. This deduction can also happen around cost changes of a particular item. So we recommend that. If you're doing cost change proposals, really this is specific for Kroger, but you can kind of add this and fill in the details with other retailers.

Make sure you have a written notice, an email works that, you know, yes, we're going to change the price of this, and then finalize that through an EDI transaction. So it's actually a requirement if you're working with Kroger, and it is with most other retailers, that you send these types of cost changes through an EDI.

And what's Nice about Kroger is they do have a timeline. So they've got, you know, for general merchandise, there needs to be 90 days prior that this EDI is sent and accepted to effective date. Health and Beauty at 60 days. And then all other items, it's about 30 days prior to the effective date. So just wanted to kind of add that there.

There GenMerch and you send it and you want to act it in 30 days. That may be able to And then you know, you can always slide by if you have some kind of specific case, but again, Croke can always come back and say, Nope, 90 days. We are going to have to incur the cost of that difference between price until we hit that 90 days.

So again, another thing to kind of watch out for.

We'll talk a little bit about Code 4s and Code 6s. These kind of seem to play together. There's a little bit of nuance between those. So I'll, when I'm talking about Code 4s, kind of foreshadowing to Code 6s as well. So those are going to be your shortage, your damage, and your do not stock. That's going to be a deduction from the supplier invoice for the unit shortage.

So let's say as the supplier I'm sending Kroger 10 cases and somehow when it arrives to Kroger's receiving, they have eight cases and they're going to say, well, I'm only paying you for eight. So if Kroger receives fewer cases than what they're billed for, they're only going to pay for the cases that have shown up.

Then there's a lot of different ways that code force can occur. So here are a couple of the recommendations for preventing these. So first off, ensure that the number of units billed to Kroger for each item matches the number of units shipped to Kroger. This can happen with item setup. If there's an error, there can happen in your.

Packing for either if you're preparing for 3PL to pick up or prepaid, whatever your shipping method is. And then other ways to prevent code force is just ensure that you're billing the correct unit type. Something that we see often is if Let's say you have a Walmart UPC and you're just plopping it into Kroger, it's going to show up as, you know, with automation and the things that are in those receivable facilities it's going to show up as zero or it's not going to be registered in their system.

So make sure that you have the correct unit type, make sure your items are set up correctly, Other points of prevention ensure that the items that you're building are for the same items that you're shipping. We see this pretty often. If suppliers are new or there's a different item type that is similar to another one, make sure that those are not being shipped in the same pallet if that's not marked correctly.

There's a lot of, is there can be a lot of issues around just labeling case packs. That can cause these types of shortages. And then lastly, be sure that your invoice UPCs match your actual shipped UPCs. Seems simple, but this kind of can start to accumulate and become issues. All right, with a code 5, this is a do not stock.

This is going to be typically related to EDI non compliance. Like I said before, Kroger requires suppliers to have EDI, so you need to be sending invoices through Kroger's EDI system. They can be manually uploaded to Lavante, however, You may receive a deduction. The deduction amount is either going to be 250 or one percent of the total invoice.

Essentially what is, whatever is greater. And this boils down to if you're not, if you're submitting your invoices manually, then that's creating an extra step for Kroger or the team representing Kroger on the other side. And Essentially, with these EDI issues, you don't want to have to deal with the Kroger team doesn't want to have to deal with adding that when it can be automated.

So, makes sense when it comes to preventing these, make sure that you have EDI set up. Suppliers that accept purchase orders from Kroger, so you're finally in Kroger's business, you have about 90 days to become compliant to receive purchase orders via EDI, as well as transmit invoices. And I don't believe that that Kroger has a specific EDI provider that they require.

However, you can use SPS Calmer, some of the other ones. It's the one that I'm most familiar with, just to ensure that your invoices are being sent through EDI to avoid this deduction. It's pretty table stakes, but again, if there's an issue with your EDI, you could always dispute if there was some kind of error when you do have EDI set up.

This one is, it is uncommon to dispute these because Kroger, you know, is going to have proof that they've manually uploaded it and it's not sent through EDI, but you could, in theory, if there is an error that is the responsibility of your EDI provider passes on to them if it's worthwhile. Again, this is kind of more of a rare edge case scenario.

All right, as you might have remembered, I said, remember code six when we're talking about code four? These feel very similar and preventing them are essentially similar. So we can talk about that prevention slide here in a second if we'd like to again. But The official definition for Code 6 is a deduction for a unit shortage from a supplier invoice.

So you can see how those really start to overlap. And really preventing these is going to be down to item setup, making sure you're labeling, you're packaging, everything is in order. And then also shipping the types of units and the amount that you said that you were going to ship. All right, then we have code 7.

This is an overage. An overage is essentially the opposite of a shortage. So we've talked a lot about, let's say you sent, you said you're going to send Kroger 10 cases, they received eight, that's going to be a shortage. In the other side of that, you've got an overage. So let's say you're going to send Kroger 10 cases, but you accidentally sent them 12.

That's going to be what an overage would look like. And overpayment made above the supplier's invoice amount on one or more items. So this may occur when received cases exceeded billed cases. And you might say, why would I ever send 12 cases when I said I was going to send 10? It. It's not always that simple.

So let's say you have UPC1 and UPC2, two different items. If they're not marked correctly, it may actually show up when they're received by Kroger as you've overshipped one type of item and undershipped or had a shortage on a different type of item. So That's a pretty common error that happens with suppliers.

And you may see, receive two different types of deductions, depending on where they're sitting on the invoice. So, just want to clarify that. And then how do overages occur? It's generally a positive deduction. So, taking, if you've, you know, sent 100 worth of merchandise, it's actually going to show up as deducting that amount that is over that.

So it's, let's say it was 120, and then you've got that 100, so that would be the difference. All right, and then we're almost through these. We've got code 8, and then code 9. So code 8 is net total dollar difference. This code can indicate either a shortage of units or a list cost issue where the billed unit price is greater than the expected unit price.

So if Kroger cannot automatically determine the reason for a discrepancy, usually it's going to get assigned code 8. So you might see this in a couple of different scenarios. Packs versus sleeves is a really common issue here. So if you're not having your items set up correctly, if you are shipping to some of Kroger's smaller brands that are underneath in the Kroger umbrella, mostly Fred Meyer and Ralph's are going to see these a lot.

You may see this code eight. Code eight tends to kind of be this catch all code. and can really require some additional context to understand. So that's why it's really important to understand that, and then you can kind of determine what path you need to go when it comes to determining if this is a valid claim or not.

And here are some of the pathways you can Determine to see if this is a valid code eight. So first determine if the deduction was related to cost or related to the units billed first versus the unit shipped. So sometimes it can be a difference in units that Kroger was billed versus the units they expected to pay kind of back to the example of packs versus sleeves.

So here are some of the ways that you could see. a code 8 come through with incorrect units. That's the bill for the units that Kroger includes on the purchase order. It could be shortage related, so you've shipped the same UPCs that you're billing for Kroger and the same number of units that you billed Kroger for.

And then cost related, make sure to provide Kroger with advance written notice of any cost changes and submit these. CostChanges via EDI before the effective date. So you can kind of see the pattern with code 8, you kind of have to step back and determine the steps needed to take, where the error is coming from, and then determine the validity once you've understood where the area the code is pointing to.

Then lastly, we've got the Code 9 pickup allowance. This is freight charges deducted for POs picked up by Kroger's carriers. Typically multiple POs are picked up on a single truck and then Kroger should only take this deduction once among these POs that they're billed for. That's one thing I want to point out there.

If you're receiving Code 9s on a specific, invoice, you really should only see this once. So that's a great validity check there as well. Okay, so how to prevent valid code nines. Kroger generally charges, we clicked through, Kroger generally charges you for shipping your goods from facilities to their divisions.

One way to avoid this is just to switch to prepaid and arrange your own transportation rather than relying on Kroger's trucks. The downside of this is going to be if you can actually pass those spines on to your 3PL. So when I say that, I mean, okay, great, you're not relying on Kroger's trucks, but now you have to tie up the loose ends between Kroger, your 3PL, and you determine who has the responsibility and then pass those spines along.

And that can be a tedious process, especially if you're having issues finding proof documentation. All right, now let's get into kind of why we're all here. How do we actually put action to these Kroger deductions, dispute them, and ultimately win money back? So a couple things to know about the world of Kroger deductions and really we can kind of zoom out and say this first bullet about Retail deductions.

These deductions can be valid, meaning that sometimes they're not at the fault of the supplier. Kind of back to, let's use the example of the shortages. Let's say you've shipped 10. They say that they received 8. There could be an issue with their receiving facility. There could be an issue with their automation.

It doesn't necessarily have to be at the fault of the supplier. And that's why we want to help here at SupplierWiki. We want to help kind of reveal one of the reasons that it may not be your fault. So, with Kroger Suppliers. You're only given 180 days to dispute these invalid deductions. Lavante store deduction data can go back years, even though the dispute window is only 180 days.

So that can be kind of frustrating, but you can go back and learn from some of those mistakes and dispute in a way that gets you from instead of denied to approved in those 180 days. And then I said this at the top of the hour, but I wanted to mention it again, PRGX is the company that hosts the website, and they also employ the personnel that are responding to these Kroger supplier disputes.

So if you're, you know, emailing your buyer and saying, I shouldn't have had this, this is invalid code, most likely they're going to say, I have no clue what you're talking about. So it's best to kind of understand that going in that you're not necessarily talking to a team that fully understands your business or the situation at hand.

All right. So, with the published resolution timelines, this is pretty specific to Kroger, not other, other retailers don't necessarily have something like this, so, kind of be good news, bad news. Good news is, this is the timeline that is supposed to happen. Kroger's on behalf of Kroger, PRGX has posted these dates saying, you know, it should be about 90 days for shortages and override late deliveries.

Same for list cost, off invoice, cash discounts, and about 30 to 45 days for unpaid invoices. The hard part of this is we've seen when the suppliers that we've worked with specifically unpaid invoices, has been a huge pain point and we've actually seen this be closer to two to three months. So this would be a great time in the chat if Anyone wants to say, you know, I've seen in my business this being less than 90 days or more than 90 days or we're still waiting on a resolution time and we don't know how to escalate this.

Let us know your thoughts. We can talk about that at the end if we need to as well. All right. And then just for more help on deductions, Kroger does have some, help articles and training videos that are in the Lavante portal. You can go there through the help slash FAQ section. This is helpful to check just once in a while, or if you're new to the team, just to kind of get a level playing field on what is required.

And I don't know how often they update these, but you know, with Kroger, this business seems to have a little bit less changes than some of the other retailers we work with, so you can always go there and check if you're having questions about ORAD, or netting, or AP fines, AR fines, and AP deductions.

Alright, so let's talk a little bit about creating a deduction claim in Lavante. So, This is pretty simple, but we'll kind of talk through some of the tips and tricks that come with understanding submitting deduction claims at Lavante. So if you're in Lavante, you've logged in, you should click on the Transaction tab and then click on Payments.

On the left side filters, a supplier should be able to enter the invoice number into the invoice number field and then scroll to the bottom and click search. So the way that Kroger runs the deductions, there's always going to be a deduction attached to the invoice number. So you can actually see all of the actions that are happening on that invoice.

And that's a really easy way to just kind of understand what's going on with that particular invoice. So any payments on the invoice number will be returned in the results. You can also see repayment there as well. All right. And then you will have a search that will pull up. It will kind of view this list of items.

You can click on the payment reference number hyperlink. So you can see that here at the top of the search to open the invoice payment with the deduction. Once the supplier clicks on that hyperlink, the supplier will receive the details on the invoice. For payment and then deductions taken. So you can really see the action that's going on there.

And then when it comes to creating the deductions claim, You can actually, once you've clicked through that information, you'll click Create Claim to begin the dispute process with this blue button on your screen, and then you can select the information here. I will pause and say, you know, we're going to send you this deck, we're going to send you the link to the recording for today's webinar, so don't feel like you have to take Copious notes, but again, this will be available for you if you want to walk step by step when you're disputing a claim.

So you'll fill in claim type. The claim amount and then the claim description. Some pro tips that we have here. Claim type is going to be really important to get correct. I'm going to have a chart here in a second that I'll put on the screen. But if you put in the wrong claim type, expect that to come back from Kroger and be denied or need updates from the supplier.

Another piece that I'll kind of get to later, but I'll mention it now. Once you've submitted it to Kroger, you cannot edit it unless they send it back to you for editing. And that can really slow down the dispute process. So make sure you understand the correct claim type, that you're putting in the correct claim amount.

We have seen suppliers who say, well, half of that deduction was incorrect and half of that deduction was correct. So I actually want to put this claim amount, just put the claim amount that Kroger has deducted from you and let them decide what needs to be parceled out. You can put that in your claim description if you want, but with the PRGX team that is reviewing this, what we see most often, put in that claim amount that is listed that they've taken as the deduction, even if you don't think you should have the full amount for some reason, because you're going to have an easier time being able to dispute when it's like for like.

You don't want to create any confusion for the PGRx team. And then the claim description, that's where you really outline your kit. your case. We have a team that has really studied these claim descriptions and understands the best ways to dispute based on codes. I won't really get into that today, but just tips and tricks.

Be as detailed as possible in the claim description. Be concise. Make sure that you're and, you know, just, you want to That is where you're stating your case for the PRDX team, so make sure that that is going to be clear, concise, makes sense and kind of points to the proof documentation that you're providing as well.

All right, and then once you've kind of gone through that information, and you've included your yeah, so once you've gone through the claim type, claim amount, you've added this information, it's going to give you the option to include any proof documentation. And here's some, a couple things I'll point out.

You want to make sure that you are labeling the correct document type, that you have the correct upload, and then document visibility. I know I have a slide about this, but I'll talk about it now. You'll want to mark that as public. So if you mark it as private, the difference between those is not, you know, every progress supplier will see it when it's public.

You're saying, I'm allowing whoever's reviewing this case from PRGX to view this. If you mark document visibility as private, it's only going to be accessible by your team. So you're going to want to mark that as public because oftentimes, Proof documentation in these types of disputes can be the hardest or the smoking gun when it comes to getting a claim approved.

And then you've uploaded your documents, you're ready to go. Go ahead and click save and submit for the, for Kroger to review the claim. If you want to come back and edit it, you can save it as a draft. I'm not. Completely sure. So if someone has any information on this I know with other suppliers, if you save it as a draft, it's in your drafts for about 14 days and then it's deleted.

I don't think that that's the case with Kroger, but someone let me know if I'm where that stands. So I would be careful if you are saving things in draft, how long those can sit in there. Obviously they 180 days, or they're kind of out of. Kroger scope for you to dispute, but let's say we're disputing this.

We're happy with where it is. We'll click save and dispute, and that will actually submit that for Kroger to review the claim. Once you've hit save and submit, you cannot edit the claim until, or if rather. Kroger hits that back to the supplier and says, you know, we need more documentation. Oftentimes, they may not say, you know, let's give you the benefit of the doubt, Kroger supplier.

We want to have you correct this. They might just move it to denied. And then lastly, let's say we did hit save and submit. We can go to the Transactions tab, click Claims, and then you can actually view the newly created claim. So if you're having an error with that, I'd reach out to the Kroger team if it's not populating, if you're refreshing your screen and you're not seeing your newly submitted claim.

But again, everything should move smoothly and you should be able to see that claim in the Transactions tab. All right, so I mentioned this earlier, we talked through these code types. These are the claims to use when you're you when you're clicking into this claim type. So you'll see with code two, you'll want to use off invoice.

With code three, you'll want to use list cost. Code four, you can use that shortage SH. Same with code six. Code 7 is an overage. And then code 8, this can be either that shortage or list cost. Remember we talked about this one is a little bit nuanced and has a wider scope. So you'll have to dig into where the issue really lies in that particular deduction.

And then code 9 is going to be pickup allowance. So that's kind of the overview of those claim codes. And we also have a chart here that shows you the dispute proof per deduction. So with code two, you know, when you're submitting that, you've got the correct code, you've put in the invoice amount, you've created a claim description that's very clear and concise.

When you go to the next page and you're adding that proof documentation, here's the proof documentation that works.

And you'll realize here I don't have Code 5 included in either of these charts. Typically these aren't disputed so if you do have an issue with this, it's It's probably going to be really hard to dispute and you'd probably have to do that more in a manual way. So wanted to clear that up because it knows it looks like I'm skipping a number, but that one really just doesn't have a claim code attached to it and it's hard to dispute.

So, like I said, we're going through the dispute proof per deduction, you can see for this Code 2, it's an allowance difference. So, you might want to include your promo agreement if the deduction is going against what was outlined there. The invoice or the payment with that deduction. Then code three, you might, the best proof that you'd have there is email approval of an item price change, purchase order and invoice, making sure that all of those match up.

And then code four and code six, Shortages. This is typically the largest issue we see across retailers. So think Walmart, Target, Amazon, Kroger. Most suppliers are getting shortages, so hopefully you feel not alone in that if you're swimming in shortages. Proof documentation there is going to be a packing lading if you're collect or a signed proof of delivery POD if you're prepaid.

Invoice and payment with deduction. Our recommendation is attach what you can you can attach. If you have everything available to you, more proof documentation is going to be better for your case. But again, if you don't have everything, it may be a question kind of to ping back to your team of why do we not have, you know, access to PODs or why can't we get the signed bill of lading?

Why is that not a part of our process? So that's a conversation that we've had with some suppliers. Then Code 7s, these are typically not disputed, but again, if you have, you know, an instance where something is very clear and you have that proof documentation, you can attach that. You may be able to pull in documentation from a shortage, kind of like the example I gave earlier in today's conversation where I said, you know, you could have two items and one comes in as a shortage and one comes in as an overage.

That could be a way that you can dispute those if You know, that overage isn't actually warranted, and the UPC that was hit as a shortage really just has some of its inventory over in that overage claim. You can kind of match those, but again, that's not necessarily typical. Code 8, if it's a list cost difference, Similar to Code 3, Email Approval, Purchase Order, or Invoice.

And then if it's shortage related, again, looks very similar to a Code 4, Code 6. It's going to be your packing list, your BOL, your POD, depending on your shipping method, invoice, or payment with deductions. And then lastly, you've got the Code 9, and that's going to be pickup allowance, and that's going to be any shipping documents, depending on your freight method and the invoice.

And again, we will send these to you. But I don't think any of this information is typically listed anywhere on Kroger, but you will be sent this deck and you'll have access to both of these. Alright, let me just do a quick time check. We're doing good on time, but I will breeze through the viewing claims in Lavante so we can get to some questions.

This is pretty simple as well. If you click the Transactions tab and then click Claims, you can see your claims, kind of like we talked about after you submitted your dispute. And on the left side of the filters, you can enter that invoice number and then scroll to the bottom and click Search. And then Suppliers, you can select My Claims in that top right corner to see individual claims versus what's disputed submitted for the company.

And if you save a claim as a draft and it remains in open status, and just to kind of call out if you haven't submitted it, it's only viewable by you, not by Kroger. So you'll want to make sure that anything that's sitting in draft, if you're expecting to dispute it in that 180 day time frame, that you're submitting that during that time and not waiting for it towards the the end of that time frame or outside of it.

And then claim statuses can be different at different suppliers at Kroger. There's about three types of claim statuses that you'll see, and this is open, pending, and pending update. Those are kind of the same, but there's a little bit of nuance, and closed. So with open, That's going to be, you know, the claim is open, you know, you, you've submitted it, or it's open, you haven't submitted it.

Pending is you've submitted it, and you cannot edit it. And then pending update is that time where Kroger's saying, okay, this is still pending, but I need some additional information from you, Kroger supplier. And then closed is When a supplier would receive a verdict from the Lavante PRGX team and that can be accepted, paid to a certain amount, or denied.

So like I said, open status as a claim is an open status if you have not submitted it to Kroger for review. It's still in your draft box to edit and review, so you'll want to, if you have open statuses that need to be submitted, go ahead and submit those and make sure that they are sitting at a pending status.

Then, like I said, when a claim goes to pending status, this is when the supplier submitted the claim, it's waiting for review, and you can go to, suppliers can go to this dispute and ask a question if needed. The note here, just once submitted, you can't actually edit this claim while it's in pending status unless the team reviewing this moves it to pending update.

So like I said, pending update is saying Kroger or the team representing Kroger requests an update on the existing dispute and only at that point can a supplier update. Claim information like claim type, claim amount, claim description, and attachments. So just want to be clear on that. If you're having trouble with pending and it doesn't say pending update, that's why you can't actually edit anything because Kroger has not allowed you to do that.

And then closed status. A claim goes into closed status after it's been reviewed and Kroger has determined the resolution. Resolution options are going to be paid. So being paid the full amount that Kroger said that they were going to deduct partially paid. So that could be anywhere from, you know, one cent to the full a cent less than the full amount or denied.

And a note here, suppliers can actually ask questions on closed claims. Whereas If you're asking a question on a closed claim, you could kind of receive some information that may allow you to re dispute in the future, depending on what that is. Okay, just some quick tips when it comes to asking questions on a claim.

With the suppliers that we've worked with, There's a difference between comments and questions, and we recommend, please, if you're wanting a response, please submit a question. It's going to be in the top right corner with a Q beside it. Kroger representatives are actually notified when you ask a question, and we'll answer that.

Yeah, they'll be able to answer that a little bit easier. And if you add existing documents, you can do that as well. That's an option. If you're submitting a comment, there's no notification to a Kroger representative. So it's going to kind of just exist in the ether and it won't necessarily come, it won't be notified to a Kroger representative.

Another piece of questions that I wanted to mention, Kroger will only look at the most recent question that you've asked. So if, let's say your team asked one question and then you ask a follow up question, essentially the way that Kroger representatives view this It's like the first question didn't exist.

So if you're going to ask an additional question, include the information that you had previously to make sure that the full picture is there. So that's just a couple of smart ways to use the question option and I would avoid using comments unless you're using those for internal use. Because the Kroger team can see them, but they're not notified of them.

And then this is kind of the plain, the part I was talking about. So asking questions on a claim. Suppliers can edit existing questions, but they can't ask another question if Kroger has not answered that previous question. And like I said, Kroger only sees the most recent questions. So if you're removing that one or pulling it back in some way, you'll want to make sure that you're providing the full picture if you still want to ask that question.

All right. And then just some more key points on supporting documentation. If you add if a supplier or a Kroger representative adds documents, they should be attached to the claim and make sure that they're, that they're marked to public or a Kroger representative. Whoever's reviewing and deciding the fate of your dispute will not be able to see it if document visibility is marked to private.

All right, I think I got through that in some good time. Yep, we've got time for questions. So Peter let me know if we've got any questions in the chat.

[00:50:41] Peter Spaulding: Okay, we certainly do. So I want to start at the top and kind of just work our way through. I think we'll be able to get through all these in 10 minutes.

The first one is a technical question that I think of, I think is very important. And I did a little bit of background reading while we were, while you were going through the webinar too. So I think I have a good enough kind of direction at least to point this person then if this is something that you aren't as familiar with.

So the question is what is ORA underscore APAR? And to the best of my knowledge this has to do with netting. So Emmanuel, I'll send a link here in the chat and everyone else, I'd highly recommend this webinar. It's it's a really kind of. unique thing that's going on at Kroger that is a kind of a problem that a lot of suppliers have had.

So definitely watch this video and do as much reading on that as you can. Basically what the, that particular code means, again, this is kind of just the limit of my understanding. I think that that is Kroger's way of letting you know that they have done a netting kind of transaction, which basically means that you have been you have been, your invoice has been paid with a separate aR kind of issues. So basically netting is whenever anyone whether a supplier or a retailer will use kind of an an account's receivable payment or lack thereof to deal with an account's payable receipt or lack thereof. So it's kind of balancing out of things through that process. Now, again, this is something that a lot of suppliers have problems with because.

It's not always compliant. It's not always valid. So I would say definitely go ahead and watch that webinar and and take some notes. We plan on doing another netting webinar here in the next couple of months because it's something that again, it's just, it's one of these perennial problems that that Kroger suppliers have.

But basically I think that code just means, hey, this payment was done with a, with money that you owed us from something else, right? So that's basically them just kind of saying, at least as far as my understanding goes, it might be more, it might be a more unique or slightly different situation. My understanding is We won't be paying this invoice because you still owe us from something else.

And yeah, that's netting. So I definitely, I watched that webinar. Allie, I don't know if you want to add anything to that.

[00:53:24] Allie Truong: No, I think you explained that well. Really, we were more on the AP side today. That's getting into the AR side. And that, and I'm, I'm reading the chat here that ORA, AP netting is really a remittance method.

We can. Yeah, Peter sent the recording link in the slides, which would kind of get into that more specifically. And you can actually scroll down on that page and download the slide deck if you want to follow along with those slides. The last thing I'll say where this can start to get confusing is it's actually viewed the same way that we kind of talked about today.

So you go to transactions and then into the payments tab, and that's where you'll start to see a lot of those netting things. So It can get confusing because we're talking about AP deductions and you're like, what is this random code that I've seen? It's kind of all bunched into the same platform or area for viewing.

So when you're, you know, looking at your Kroger claims, I would say try to start with understanding, is this AP? Is this AR? Is this a netting issue? Is this a code? And that can kind of get you on your way. But we'll be sure to do the netting webinar here soon.

[00:54:40] Peter Spaulding: Okay hang on a second. Let me go to the next one. So this guest was wondering if the the codes that we discussed, the deduction codes are visible or showing in Lavante. Depending on what is on your check amount, it may say code 2. And then that would give you an understanding that it would be a, like, let me go back to my.

[00:55:14] Allie Truong: My handy dandy chart here. Yeah, it may say, you know, promo allow difference or code two. And then this is the deduction code that it would be tied to. So I don't think necessarily it has this, you know alphanumeric code here, but I believe it has either this, you know, description type or the code type attached to it is how I understand it.

[00:55:46] Peter Spaulding: All right. One person is asking about the 180 day window, how strict that is because, and this is something that we've heard from other Kroger suppliers too we have disputed Kroger claims and they just didn't respond. And now they are telling us they're expired when we were waiting on them.

So this sounds kind of like par for the course, like this is something other people have experienced too. Let us know if that's true. The 180 day window isn't. incredibly short by most kind of retailer standards. Amazon's is like 30 days and you get one shot. But I, if there, there may be a situation where Kroger is kind of just ignoring these and waiting until the 180 day window to be like, okay, now we're not actually going to accept this because it's it's overdue.

I'm curious about how that, how the SupplyPike integration would kind of work with that or not. If that would be something that. SupplyPike is actually helpful for or not if, if we're just kind of getting to this point where Kroger is just, is just not paying attention to them. I don't know if you have anything to add to that, Allie.

[00:56:58] Allie Truong: Yeah, I would say we'll throw our emails up here in a second. I can even go to that slide as we're, as we're talking. So my recommendation is get in touch with us and we can kind of understand at a claim basis, if you're, what you're looking at and we have a team that works on this and that's kind of the cool part of the products that we work on here at SupplyPike.

We have that information baked into our software. When it comes to that specific question, and I'm just reviewing it to make sure I'm getting to it. Can you go and dispute claims outside of the 180 day limit? Yes. Actually, some of the suppliers we work with at other retailers like Walmart, it's a little bit more lenient.

And they're able to dispute those. I would say, do accounting teams, do your finance teams, your AR, AP analysts actually have the time to do this? I'm not sure. So, my recommendation is I'd focus on the fresher claims and actually working in that window that Kroger has outlined. But if you have some of these mature claims figuring out, and again, this is where you would email us and we'd get you in contact with some of our, our teams that work specifically on some of these mature claims at Kroger.

If there are areas where you can, you know, play around and actually see those received back instead of, you know, close loss in terms of deductions.

[00:58:40] Peter Spaulding: Okay, great. One last question that is kind of one that I would sort of like to just deflect to everyone on the call still too. We've received some deductions however, Lavante is not showing us any code or reasons for these deductions.

How common is this for you? Is this something that you all have seen as well? Or is this a sort of unique thing? Ali, do you have anything you'd like to kind of, any kind of answer you would like to offer for that question?

[00:59:09] Allie Truong: Yeah, I would say let me see if I can find the slide in time. Let's see.

So once you click into this, you should be able to see some, some list of what information you have. Again, we don't have this on the slide because We're not, you know, in Lavante and we don't want to pull up any information that isn't ours, but you should be able to see some pointing to either the claim code or one of these terms.

If not, I would say start kind of researching. You could even you know, ask a question and submit this. There is also training, like I said, in the help slash FAQs that may be helpful but we can also, you know, work with your team if you're interested in talking to some of our, our experts on Kroger specifically and, you know, what you're seeing and if it's some kind of issue with your claims or, Whatever the issue may be, we can kind of help speak to that, so.

[01:00:22] Peter Spaulding: Okay, great. This last question I think that we have time for is I'm not sure the extent to which we can answer this question or not, but does Kroger use an inside payment system for alcohol sales, or do you use the alcohol payment system FinTech? My understanding from Walmart is just that it's on a completely separate deductions sort of like map, like it's not something that we've even explored at all because it's so kind of heavily regulated and, and set apart from the regular AP deductions, the regular compliance programs.

It's all kind of its own thing. So I'm not sure what Kroger's like. Allie, I don't know if you have anything.

[01:01:04] Allie Truong: Yeah. It's pretty standard that, you know, if you're in a, if you're in a category like alcohol, that it may be different, just depending on rules. I would say going to the Help and FAQ tab, I apologize that I'm not, I'm really not going to be helpful when it comes to the alcohol category, just because you don't have to.

For the most part, if there's a process, I can bet that there might be something that's just a little bit different or just completely different when it comes to alcohol. So if you email this question, I will send it to some of the, our other team that works on Kroger specifically, and may have some knowledge about alcohol, but again, I'm sorry, I'm not helpful when it comes to that, just because it's so different than GenMerge, Health Beauty, some of the other like main categories.

[01:01:55] Peter Spaulding: Yeah, I was going to say, go ahead and email us and we can pass it on to someone who, who knows for sure. But yeah, again, my understanding is that this is kind of a federal thing. It's like, it's, it's beyond, it's beyond the scope of the, the things that retailers can, can really regulate. So I think it's a completely separate thing.

But yeah, email us for sure. And we'll be able to pass that on to confirm that. And thank you all. That's That's all the questions and we're right at time. So thank you all for joining us. Join us next time and everyone go and watch that netting video. It's super important for suppliers to be aware of that as well.

[01:02:34] Allie Truong: Awesome. Thank you, Peter. And thank you for everybody who joined. Hope to see you at another webinar soon. Take care. See y'all.

Hosts

- Read More

Allie Welsh-Truong

SupplierWiki Content Manager

Allie Welsh-Truong is an NWA native with a background in the CPG industry. As Content Manager, she develops and executes SupplierWiki's content strategy.

- Read More

Peter Spaulding

Sr. SupplierWiki Writer

Peter is a Content Coordinator at SupplyPike. His background in academia helps to detail his research in retail supply chains.

Presentation

Kroger Deductions 101

View the Kroger Deductions 101 Slide Deck to learn all about Kroger deductions and how to get visibility into them and dispute them.

Related Resources

Sponsored by SupplyPike

About SupplyPike

Grow your retail business without frustration. Fight deductions, meet OTIF goals, and maximize cash flow in the built-for-you platform, powered by machine learning.

About

SupplyPike helps you fight deductions, increase in-stocks, and meet OTIF goals in the built-for-you platform, powered by machine learning.