The Differences between Disputing Deductions Individually and Settlements

Learn about:

- The pros and cons of the Walmart settlement process

- The pros and cons of individually disputing deductions

- How to switch between them

Disclaimer: As of Oct 2022, the Walmart Accounts Payable Team announced the end of the settlement process for AP deductions. Suppliers have until May 1st, 2023, to fully transition to the new process. For the most up-to-date information, take a look at the article, Walmart Discontinues Settlement Disputing.

Walmart suppliers are familiar with the pain of shortage deductions (Walmart deduction codes 22, 24, and 25). Invalid short-shipping claims can take over 20% off your invoices, putting a significant strain on your cash flow. Fortunately, these deductions are disputable with the right documentation and knowhow.

There are two ways of disputing shortage claims. One, you can utilize Walmart’s deduction settlement process, or two, you can dispute shortage deductions individually via Direct Commerce (DCI).

Let’s go over the pros and cons of each process.

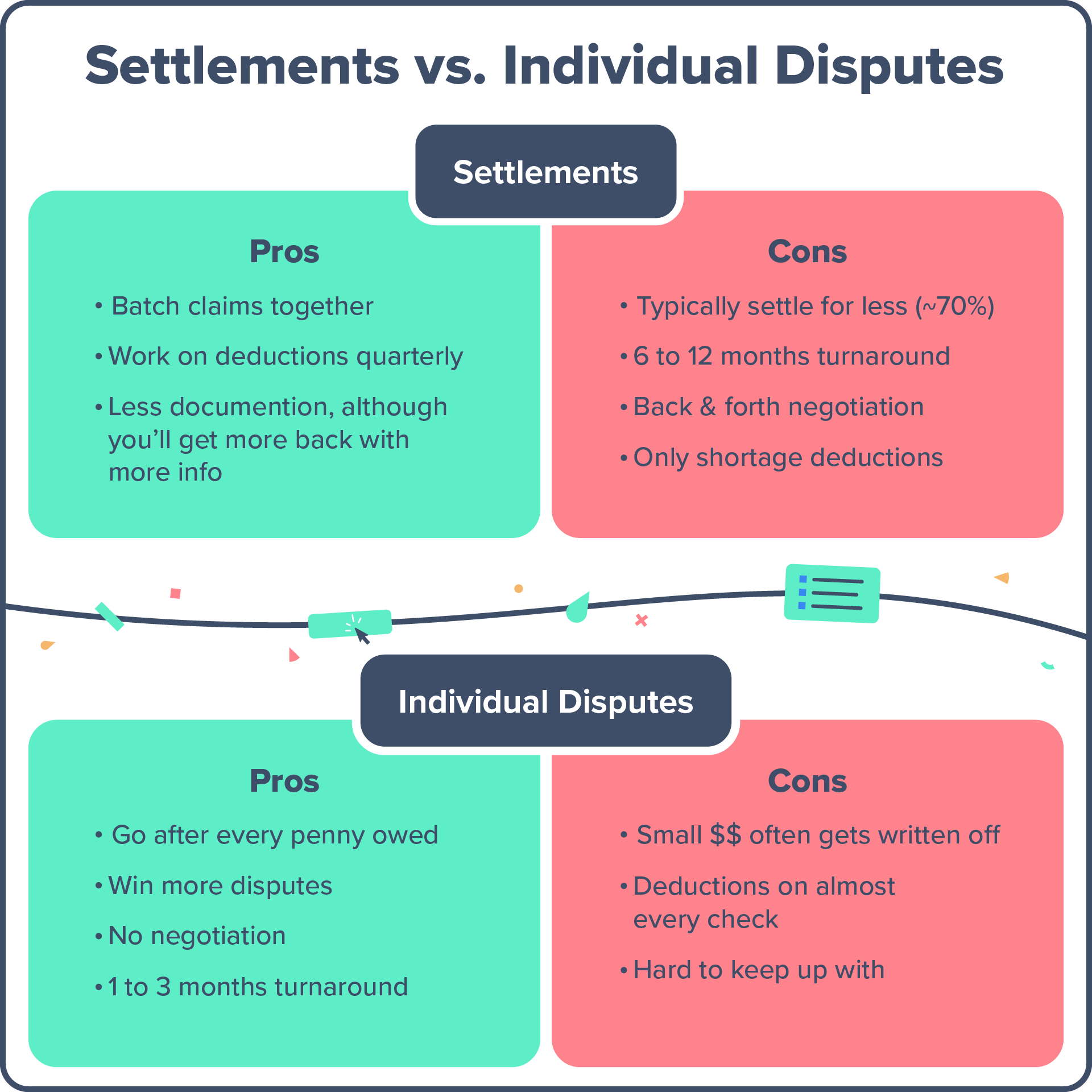

Pros of Walmart’s Deduction Settlement Process

The settlement process is a way to negotiate repayment of deductions over a specified period. With the settlement process, you batch claims together, so you’re disputing all of your open shortage deductions at once, typically every quarter.

Because of this, you only have to deal with deductions quarterly. You can take the time to gather all of your documentation and do all of your research to ensure that you get the most of your settlement back.

Typically, the settlement process involves slightly less work to research, as you are only showing the documentation for a sample set of the deductions you received over the past quarter. You do not have to provide documentation for each deduction as you would if you were disputing them individually. However, the more proof you have, the more money you’re likely to get back.

Related Reading: How to Navigate Walmart’s Deduction Settlement Process

Cons of Walmart’s Deduction Settlement Process

Of course, the settlement process isn’t perfect. Typically, you end up settling for less than what you are owed. Anecdotally, we’ve found that suppliers who use this process only receive repayment on approximately 70% of invalid shortage claims on average.

There is also an immediate negative impact on cash flow, as it often takes six to twelve months to get paid back. Of course, it also takes time to negotiate back and forth, and even then, you aren’t guaranteed all of your money back.

Even though you only have to find a sampling, you still have to track down documentation in the form of Bills of Lading (BOL) and Proofs of Delivery (POD).

The settlement process only typically deals with three deduction codes that are shortage-related. However, there are dozens of deduction codes for money lost on your checks that are disputable.

Pros of Individual Disputing

Utilizing the individual deduction dispute process by disputing deductions (shortages and others) via dispute portals, such as DCI, allows you to go after every penny owed to you. You can dispute deductions as far back as two years with Walmart.

Via disputing invalid shortage deductions individually, you can win these disputes more than 95% of the time as long as you have the correct shipping documentation as proof. By avoiding a settlement, you are likely to receive more money back for more deductions.

You’ll get better cash flow by avoiding the settlement process. Individual disputes are typically paid back in one to three months instead of waiting for up to a year.

Cons of Individual Disputing

However, many shortage deductions are small dollar amounts, so these often these get written off. If you don’t have a tool to make the process more seamless, then it might not make financial sense to spend the time to dispute deductions for small dollar amounts. This can leave significant money on the table.

Additionally, many suppliers see deductions taken from every payment remittance, so it can be challenging to keep up without the proper tools. Again, you have to weigh the ROI of receiving all of your money back versus the time you spend on individual disputes.

Related Reading: Disputing Your Walmart Deductions On A Schedule

Infographic summing up the pros and cons of settlements versus individual disputes

Switching from Settlement to Individual Disputes

As you can see, the settlement process can sometimes save you work hours, but in the long run, you’ll receive more of your money back with individual disputes and you’ll receive it faster. Utilizing a tool for individual disputes will pay for itself when switching from settlements.

If you find that the settlement process isn’t right for you, you can switch to disputing claims individually, but only after your current settlement term ends (which is usually quarterly).

However, once you switch to individual disputing, you cannot change back to being on the settlement process for one year, so you’ll need to weigh the pros and cons carefully. Take the time to find out how much money Walmart would give you back and compare that with the time it takes to properly settle a deduction.

If you find, for example, that you end up tracking down the documentation in terms of BOLs and PODs for all of your deductions – and not just a sample – in order to maximize your settlement, then why not dispute them individually? The payoff and turnaround time are likely worth it.

Of course, obtaining a tool that individually disputes each deduction has a huge advantage. It would remove the hassle and time-consuming process of researching and acquiring the proper documentation for each dispute. A tool that provides this documentation for you will help you individually dispute each and every deduction (including ones that aren’t just shortage-related), allowing you to get more of your money back. Additionally, this method skips the lengthy process of negotiating back and forth, so Walmart will repay you in a much shorter amount of time.

To switch processes, send a request to Walmart to be moved off settlement at the end of your current settlement term. Request access to the Direct Commerce, Inc. (DCI) portal to begin disputing individually. The email is apsettle@wal-mart.com.

Tools for Disputing Deductions

With the right toolset, you can have the best of both worlds! Rather than spending almost an hour on each dispute or navigating the settlement process and potentially losing money, you can use Deductions Navigator for one-click disputes.

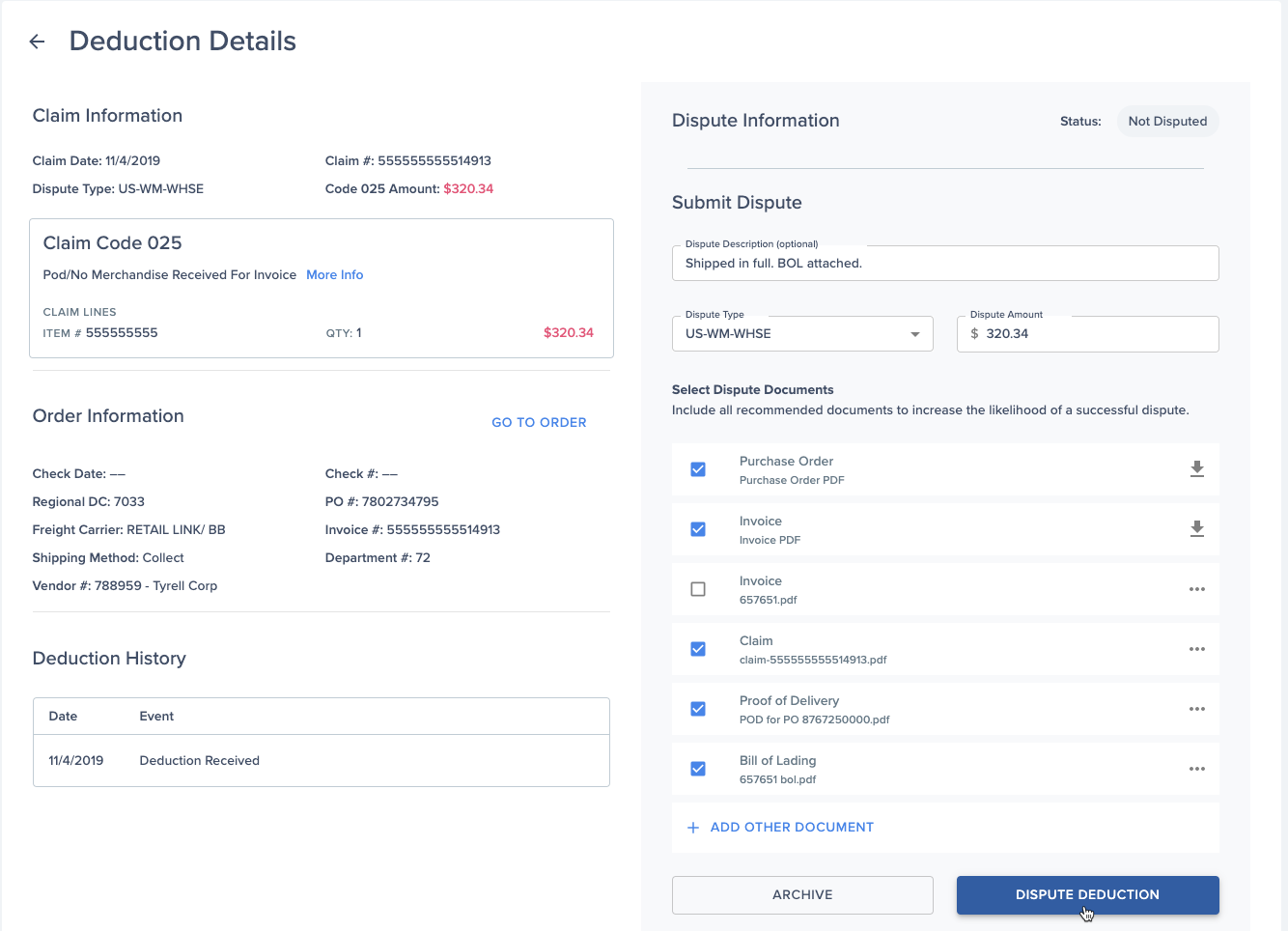

Deductions Navigator – Dashboard

With our tool, you have full visibility of your deductions, helping you nail down trends and find pain points in your supply chain. SupplyPike offers automatic document retrieval, so you don’t have to go after your 3PL or logistics company for BOLs or PODs. We provide them to you automatically.

With the click of a button, you can quickly dispute an invalid deduction and get your money back.

Deductions Navigator – 1-Click Disputes

Related Resources

Written by The SupplyPike Team

About The SupplyPike Team

SupplyPike builds software to help retail suppliers fight deductions, meet compliance standards, and dig down to root cause issues in their supply chain.

Read More

About

SupplyPike helps you fight deductions, increase in-stocks, and meet OTIF goals in the built-for-you platform, powered by machine learning.

View SupplyPike's Website